The Net Present Value Of A Project Is Blank______. – Z1 = cash flow in time 1 z2 = cash flow in time 2 r = discount rate x0 = cash outflow in time 0 (i.e. The spreadsheet function for calculating net present value is ____. The net present value of a project is: A) the project's cash flows subsequent to the initial cash flow have a present value of zero.

B) the project produces a net income of zero for every year of its life. Sum of the present value of cash inflows and the present value. Based on the value, should the company proceed with the project? Compute the net present value of the project taking all cash flows into consideration.

The Net Present Value Of A Project Is Blank______.

The Net Present Value Of A Project Is Blank______.

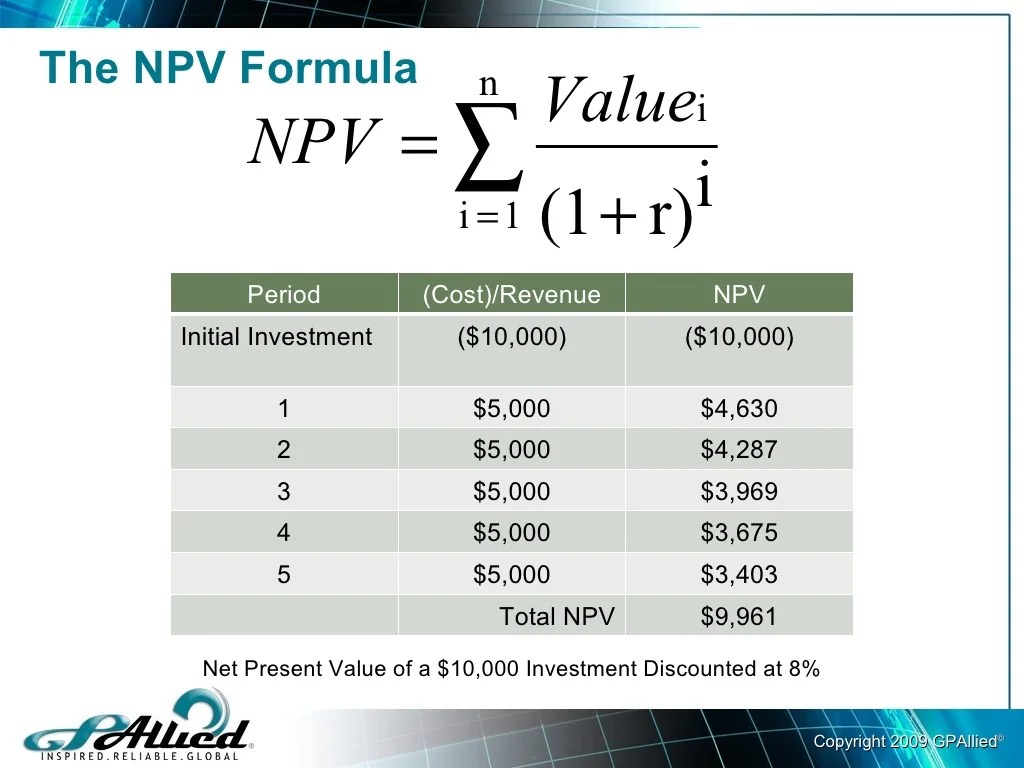

Net present value (npv) of a project represents the change in a company's net worth/equity that would result from acceptance of the project over its life. The difference between the present value of cash inflows and present value of cash outflows for a project. By definition, net present value is the difference between the present value of cash inflows and the present value of cash outflows for a given project.

Net present value is the difference between present value of cash inflows and present value of cash outflows that occur as a result of undertaking an investment project. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows of a project or. Npv () the amount of time needed for the cash flows from an investment to pay for its initial cost is the _____.

If you wonder how to calculate the net present value (npv) by yourself or using an excel spreadsheet, all you need is the formula: More specifically, you can calculate the present value of uneven cash flows (or even cash. It may be positive, zero or negative.

Npv formula the formula for net present value is: Where r is the discount rate and. Preview terms in this set (62) how managers plan significant investments in projects that have long term implications such as purchasing new equipment or introducing new.

Solved (a) What is the net present value of a project with

Solved What is the net present value of a project with the

Solved 1. What is the net present value of a project with

Net Present Value (NPV) Meaning, Formula, Calculate, Example, Analysis

Net Present Value Formula Examples With Excel Template

What is Net Present Value Definition, Examples, FAQs

Mastering Net Present Value in 2023 A Simplified Guide

Solved Calculate the net present value of a project which

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

Net Present Value (NPV) Definition

Net Present Value formula and example Toolshero

Part 2 NPV Net Present Value Calculation & Net Present Value Example

How to calculate net present value example

Net Present Value Definition & Example InvestingAnswers

Net Present Value Formula Examples With Excel Template